The way consumers discover, shop and buy has undoubtedly changed; last year, US online holiday shopping increased 32% from 2019, marking the highest volume of online shoppers to date (eMarketer). This year, holiday ecommerce sales are predicted to be on par, in excess of $200 billion (eMarketer). With the massive increase in online demand, this will challenge the status quo for brands and retailers going forwards.

Whether you’re a multinational brand or a small boutique retailer, what trends can we expect to see, and what can we learn from the pivotal holiday shopping season that was 2020?

An extended online holiday shopping season, again.

Last year, in-store shopping was considerably restricted, and there were many uncertainties surrounding logistics and supply chains; this prompted retailers to kick off their 2020 holiday shopping season as early as October; Black Friday deals were being rolled out in mid-October, and Cyber Monday stretched across a whole week, rather than a single-day as per previous years. Retailers were quick to offer online deals, ensuring they could maximize sales and meet the massive increase in online demand.

This year, we’ve also seen many big US retailers, such as Walmart, Target and Best Buy, announce their in-store closure on Thanksgiving Day, so we can expect to see the same head-start from retailers, pushing more consumers online for the 2021 holiday season.

This extended season should allow some relief for supply chains and shipping partners, with the hope of avoiding last minute ‘fulfilment crunches’.

Online promotions will match those in-store.

Last year, we saw ‘doorbuster’ deals on major holiday shopping days being no longer solely restricted to brick and mortar, which is looking likely for 2021. And with Thanksgiving Day store closures this year, consumers will flock to the virtual shops to avoid missing out on promotions; ecommerce sales for the Day are expected to reach an incredible $6.21 billion. This, combined with the quick introduction of online promotions in 2020 when stores were forced to close, proves that retailers can replicate, match and offer much of the same in-store shopping, sales and promotional experiences online, serving customers wherever they choose to shop.

An increase in both online and hybrid shopping.

eMarketer predicts retail commerce sales are projected to make up 18.9% of total holiday retail sales, up from 17.5% last year. While physical stores are reopening in many areas as we head into the holiday season, it’s prevalent that online shopping is here to stay.

As consumers work through their decision making process, they may encounter multiple digital touchpoints with a product or brand, and having the convenience to shop straight away, online, or the ability to head in store to see it in person is key. And with hybrid solutions continuing to be offered, such as click and collect, buy online pay in store (BOPIS) or curbside pickup, new convenience expectations have been set. In a National Retail Federation survey, they found that 70% of people said hybrid solutions such as BOPIS greatly improved their experience based on convenience.

Retailers have proven over the last year that they can offer the same promotions online, allowing customers to shop wherever it suits them. In-store purchases have become more intent-based and transactional, and online and hybrid solutions have become more experiential and convenient. For retailers to achieve long-term success, it’s imperative they offer frictionless, omnichannel experiences to consumers.

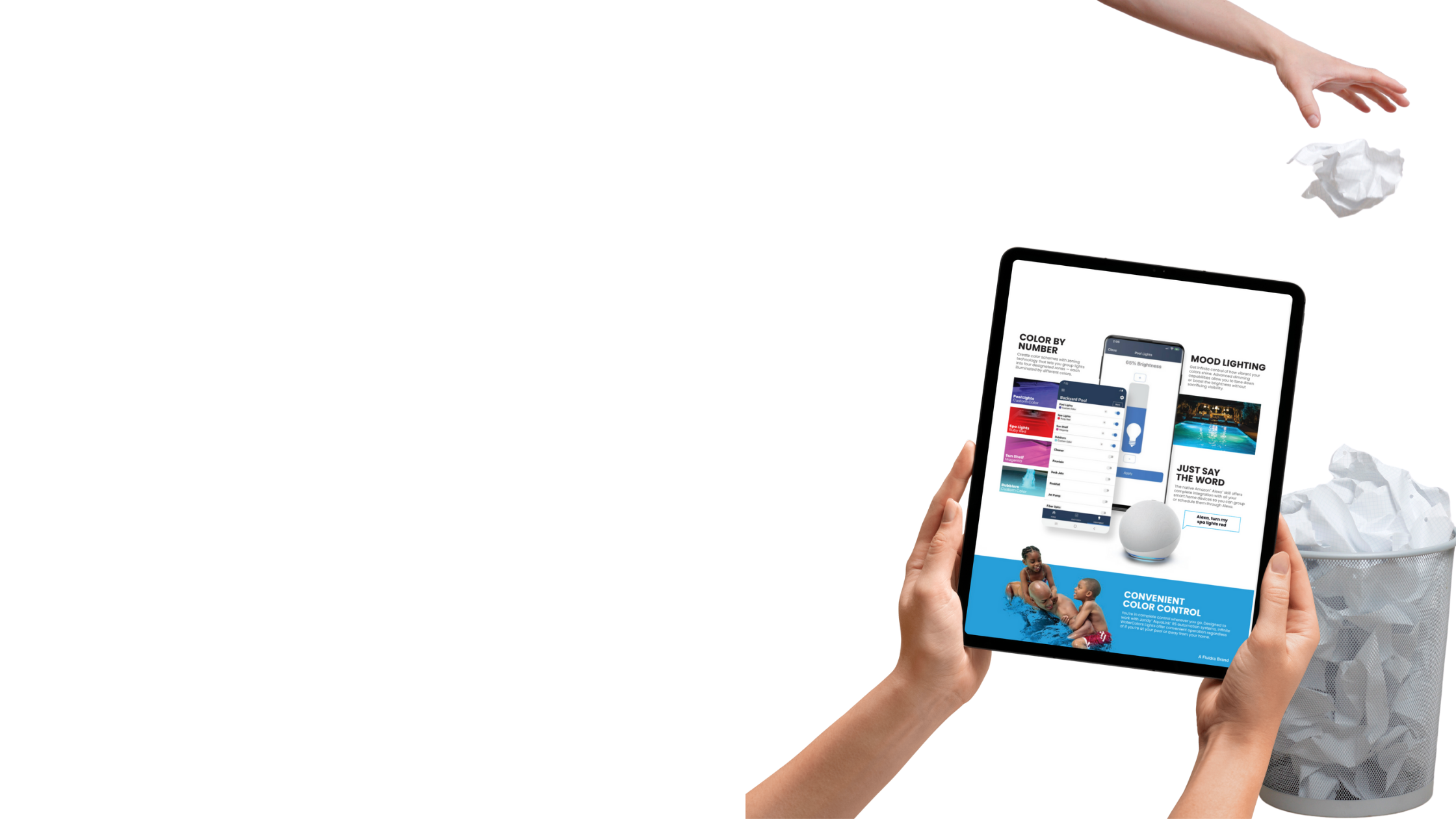

Recently, we wrote about the role digital catalogs can play in product discovery, in the omnichannel landscape retailers now compete in. For online consumers in the product discovery phase, they’re happy to browse and be inspired. This retail holiday season, digital catalogs are a tool retailers can utilize to supplement their online store and marketing initiatives, showcasing product collections, to seamlessly guide consumers from discovery to purchase.