The holiday season is undoubtedly going to look a little different this year; COVID-19 has changed the way we do things. We’ve watched the dismantling of many industries as

we know them, but we’ve also seen resilience, and with the holiday shopping season

upon us, we’re about to experience first-hand how retailers around the world will adapt

to meet both the demands of their consumers and the demands of the evolving retail

climate, in order to survive.

This time of year brings with it shopping events like Thanksgiving, Black Friday, Cyber Monday, Christmas & Boxing Day, all of which retailers and consumers alike look forward to. And this year is no different; even during a global pandemic, there’s no sign of consumerism and the ‘need for new’ slowing down. The recent and enormously successful Chinese shopping event ‘Singles Day’ is testament to that, with Alibaba sales surpassing US$74 billion, smashing last year’s record. But how do these events look in a COVID-ridden world? Will we still be able to get our hands on the ‘deals of the year’? Will retailers be open to foot traffic? What about stock issues, or shipment delays for online purchases?

There are numerous uncertainties surrounding these events this holiday period, so what

are retailers doing in a season they say is unlike any other they have experienced?

To avoid overcrowding, retailers are reducing the number of customers allowed into

their stores at any one time with spaced, single file lines outside. They’re also increasing

their e-commerce deal offerings to encourage online purchasing, instead of largely in

store (i.e. Black Friday ‘doorbuster’ offers.)

With up to 85% of people doing their shopping online since the pandemic began (1),

e-commerce is now an essential competency for retailers in order to survive. But with

the postal systems already operating at high capacity, there’s worry of further shipment

delays and not receiving orders on time. In an effort to capture but spread out demand,

as well as to relieve pressure on the postal system, retailers are starting their Black

Friday deals online, early and for longer.

Stock issues are a little harder to anticipate, however spacing deals across a longer

period enables a retailer to offer deals with what they’ve got on hand. Some stores are

also offering click and collect and curbside pickup, a service many consumers say they

want to see this season.

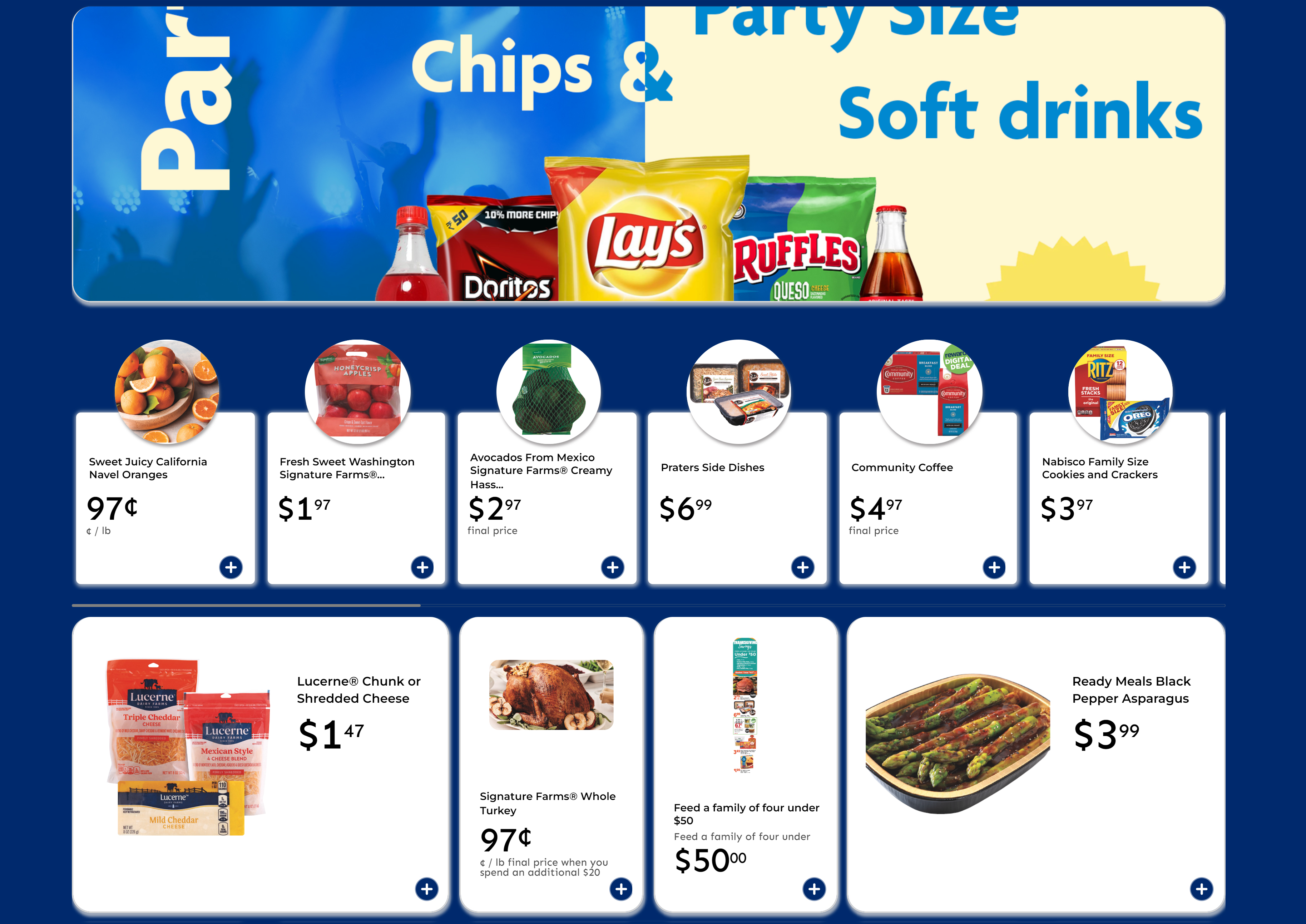

In the US, Walmart, perhaps one of the most anticipated Black Friday players, is closed

on Thanksgiving, but has launched ‘Deals for Days’ which sees them spreading Black

Friday events across the month of November. They’re also increasing online deals in an

attempt to regulate the number of shoppers in store and spread out the expected influx

of online orders. Home Depot, however, has bitten the bullet and are ditching the event

altogether, instead introducing deals across two months. Lowe’s is starting a Christmas

tree delivery this year, making it easier for people to get a tree without leaving their

homes.

In New Zealand and Australia, where the apparentness of COVID-19 lessens and

restrictions ease, the wake of the global pandemic is still presenting challenges as we

navigate back as close to life-as-normal as we can. With overwhelmed post systems,

stock issues and delays in goods from global wholesalers and retailers, and a decline in

instore purchasing, these are just some of the factors that retailers will need to contend

with this holiday period, in order to meet the needs of their consumers.

Offering holiday season deals online, early and for longer, with click and collect options, is

common ground among retailers around the world, whilst trying to navigate and

acclimatise to the ‘new normal,’ as well as accommodating shifts in consumer behavior.

And although stores will be open (at this stage), retailers will need to find a balance

between driving sales and keeping their shoppers safe. Adapting to this is key.

Sources.

1. Bank of America, US Department of Commerce, Shawspring Research 2020. 1.